The lure of the triple-net lease

By Edward LaPuma and Maxwell Eliot

As they hunt for yield and look to shield themselves from inflation, institutional investors are taking a growing interest in a niche part of the leasing market that presents both opportunities and challenges. View the Published Article here.

Ever since the unprecedented monetary policy response to covid-19 sent investment yields to historic lows, institutional investors have been desperately looking for ways to achieve yield while maintaining an attractive risk-return profile. The inflation spike last year further complicates matters. The spectre of sustained inflation threatens to further erode

fixed-income yields.

The dual problems of relatively low yields and rising inflation has spurred an interest in single-tenant, triple-net lease investing. While interest from institutional investors has been growing over the last decade, the past few years have seen the strategy go mainstream.

In their simplest form, single-tenant, triple-net lease investments (also known as sale-leaseback and net-lease investments) involve the ownership of a commercial real estate asset leased to a single tenant under a triple-net lease. This is a lease agreement where a corporate tenant promises to pay all the expenses related to the property, including real estate taxes, insurance, and all maintenance, utility usage, and repairs related to the property. These are paid by the tenant in addition to rent.

By contrast, in a typical commercial lease, some or all of these payments are the responsibility of the landlord. When structured correctly, a single-tenant, triple-net lease creates a bond-like stream of cashflows backed by the corporate

credit of the tenant. Importantly, due to the differences between the corporate credit and real estate markets, triple-net

leased yield almost always substantially exceeds the yield generated by a traditional fixed-income investment in that

same tenant company. As a result, institutional investors have flocked to the attractive risk-adjusted returns generated

by the strategy.

Many large private equity firms are now playing catch-up, putting together new fund management teams to allocate capital into this strategy. However, there are pitfalls to this seemingly simple strategy. Institutional investors can avoid these by selecting managers with long track records demonstrating experience in single-tenant, triple-net lease investing.

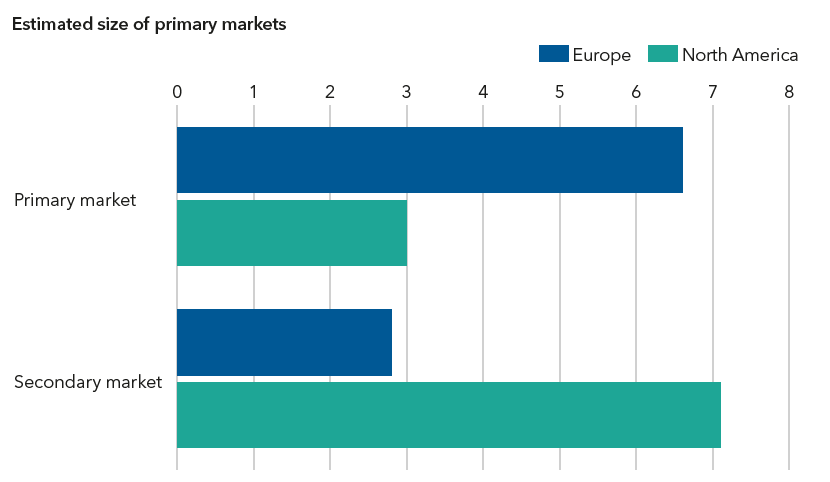

The market for single-tenant, triple-net leased properties can be divided into two segments: the “primary” and “secondary” markets. The primary consists of sale-leasebacks which involve direct origination of the investment from the company that owns and occupies the real estate and, as a result of the transaction, becomes the tenant/corporate obligor. This sale-leaseback transaction creates a single-tenant, net-leased asset.

By contrast, the secondary market includes all subsequent trades of existing single-tenant, triple-net leased properties from one investor to another. Although annual transaction volumes in the more easily accessible secondary market are frequently six to eight times that of the primary market, the potential size of the latter is massive, as represented by the amount of

commercial real estate directly owned by corporate occupiers, estimated at $3 trillion in North America and €6.3 trillion in Europe.1

“Many large private equity firms are now playing catchup, quickly putting together new fund management teams”

Primary yield higher

Importantly, investing in the primary market provides substantial benefits over secondary investments. Institutional investors would be wise to partner with managers focused on this attractive segment of the market. Due to the second-hand nature of the secondary market, yields tend to be lower than those in the primary market. As a result, primary market investments feature a more attractive risk-return profile. In addition, lease terms in the primary market (typically 15-25 years) are much longer than those found in the secondary (typically less than 10 years).

Finally, by operating in the primary market, investors can forge a direct relationship with the tenant. This further enhances the investor’s downside protections by facilitating a direct line of communication in downside scenarios.

The direct tenant relationships established in the primary market also facilitate a more comprehensive underwriting of both the tenant’s corporate credit profile and the real estate asset. Distinctly and comprehensively underwriting both of these disparate disciplines is critical to the creation of the double layer of protection – a hallmark of a well-structured triple-net lease investment. Successful sale-leaseback investors must perform a detailed underwriting of the credit of the tenant from the perspective of the traditional credit investor. If the tenant maintains its credit worthiness, the value of the lease cashflows will remain stable, and the investment will perform as expected.

Investors must also independently underwrite the value of the real estate, which serves as protection for the investor in the event of a tenant default. Assessing the “dark” value of the property and establishing below-market rents are critical. If the tenant defaults, the investor can fi nd a new tenant for the property to replace the lost cashflow, or even sell the vacant property to recoup its principal equity investment. Too often, new investors to sale-leaseback investing focus on the credit of the tenant or the value of the real estate to the detriment of the other, resulting in a loss of this critical double protection.

By investing in the primary market, investors have the opportunity to generate a substantial increase in investment value by turning an owner-occupied asset into a single-tenant, triple-net leased asset with contractual cashflow tied to the property through the lease. However, this can only be realised if the investor has the experience and knowledge to properly structure the lease.

Importantly, operating in the primary market gives investors the opportunity to directly structure a single-tenant, triple-net lease and thereby carefully craft downside protections that further enhance the value of the investment. Attention to details such as assignment, subletting, ‘go-dark’ and casualty provisions are critical.

Properly structured triple-net leases must contain full financial reporting requirements for the tenant and ideally also include financial covenants and cross-defaults with the tenant’s debt. Properly structured triple-net lease investments also benefit from inflation protection in three forms. First, the investor benefits from the ownership of a real asset, which typically rises in value during periods of inflation. Second, a triple-net lease protects investors from expense inflation by making all operating expenses the tenant’s responsibility. Third, and most importantly, most triple-net leases contain contractual rent increases, providing further protection against yield erosion due to increasing inflation. Escalating cashflows over time are a rarity in traditional fixed-income investing but are a key feature of properly structured triple-net leases.

While it may be tempting to jump directly into the single-tenant, net leased market, most institutional investors and fund managers without the deep sourcing network required to find primary market sale-leaseback opportunities and the experience structuring downside protections in leases often achieve sub-optimal results. Yet there are a few private funds with long track records of successful experience and strong sourcing relationships with companies and with private equity sponsors seeking to generate cash to re-invest in their businesses. These managers are well-positioned as rising inflation, relatively low yields and volatile equity markets continue to provide a compelling backdrop for primary market triple-net lease investing.

1. Estimated corporate owner-occupied real estate as 30% of North American and 70% of European commercial property holdings based on market values from A Bird’s Eye View of Real Estate Markets: 2021 Update. PGIM Real Estate Investment Research, October 2021.

Edward LaPuma is co-founder and managing partner and Maxwell Eliot is director of acquisitions at LCN Capital Partners, a New York-headquartered primary sale-leaseback specialist.

About LCN Capital Partners

Founded in 2011 by Edward V. LaPuma and Bryan York Colwell, LCN has assets under management in excess of $6.0 billion across its seven funds. Headquartered in New York City, LCN also has offices in London, Amsterdam, Cologne, and Luxembourg.

LCN Capital Partners is a recognized leader in the primary sale-leaseback and build-to-suit markets, where investments and leases are directly originated with corporate users of mission-critical real estate. LCN delivers a long-term solution for its tenant-clients by providing a non-bank capital resource, efficient monetization of on-balance sheet real estate, continued operational control of key assets, enhanced financial metrics, and potential tax benefits. In addition, LCN’s investing partners benefit from the long-term and inflation-protected distributions that it supplies. For more information, please visit: https://www.lcnpartners.com/.